The Invisible Risk: Why Growing Organisations Fail Financially Despite Perfect Compliance

In the world of business finance, compliance is often celebrated as the ultimate indicator of stability. If filings are completed on time, taxes are paid, and audits are signed off, leadership assumes the organisation is on a strong path. But after 15 years of working with companies, NGOs, and fast-growing startups, I've observed a surprising and uncomfortable truth:

A perfectly compliant organisation can still collapse financially.

Many founder obsess over compliance, assuming that meeting statutory requirements equates to financial health. Yet some of the biggest financial failures I've witnessed had clean audit reports and zero regulatory defaults–until, suddenly, they were gone.

So, what goes wrong? This article dives into one of the least discussed, yet most dangerous blind spots in finance.

Operational Financial Discipline–the everyday behaviours that determine whether money grows or disappears.

When Compliance Isn't Enough to Prevent Startup Failure

Let me share a real, industry-neutral case:

A thriving startup scaled from 3 crore to 25 crore in annual revenue in just three years. All statutory filings were timely, GST returns were spotless, and payroll was flawless. Investors were confident.

Yet, within 18 months, the business shut down unexpectedly.

During closure meetings, the founder repeatedly asked:

"We complied with everything! How did we still fail?"

The uncomfortable truth:

- Compliance only protects against legal penalties.

- Operational mismanagement–undisciplined spending, weak cost control, and delayed receivables–destroyed the company from within.

Key lessons:

- No law mandates healthy cash flow.

- No regulation prevents cash burn.

- No statutory auditor can detect over spending driven by excitement.

Growth without financial discipline is not real growth–it is disguised loss.

Where Organisations Silently Leak Money: 3 Financial Blind Spots

Through multiple audits and advisory engagements, I've identified three recurring patterns that silently drain cash and threaten business survival:

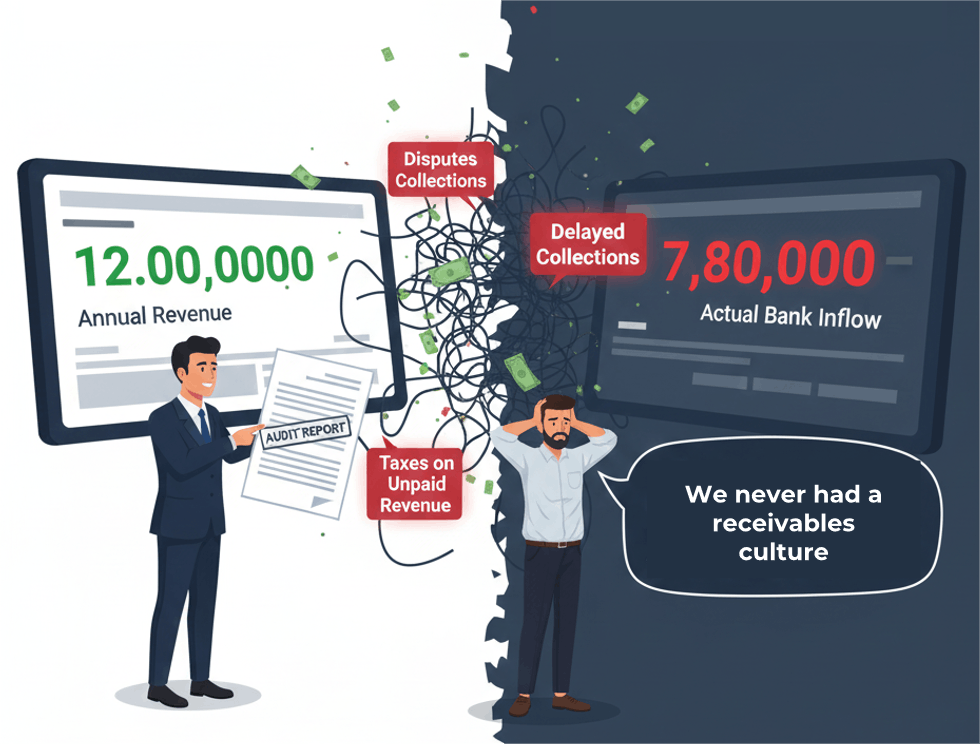

1. Revenue Recorded ≠ Money Received

Many organisations report healthy book profits, but the actual cash inflow tells a different story. A services company recorded 12 crore in annual revenue. But the actual bank inflow was 7.8 crores with the remaining revenue tied up in disputes and delayed collections. Taxes were paid on revenue never received, straining working capital.

The CFO admitted:

"We never had a receivables culture–relationships mattered more than timelines."

Lesson Learnt: Business cannot survive on future promises alone. Cash flow management is critical.

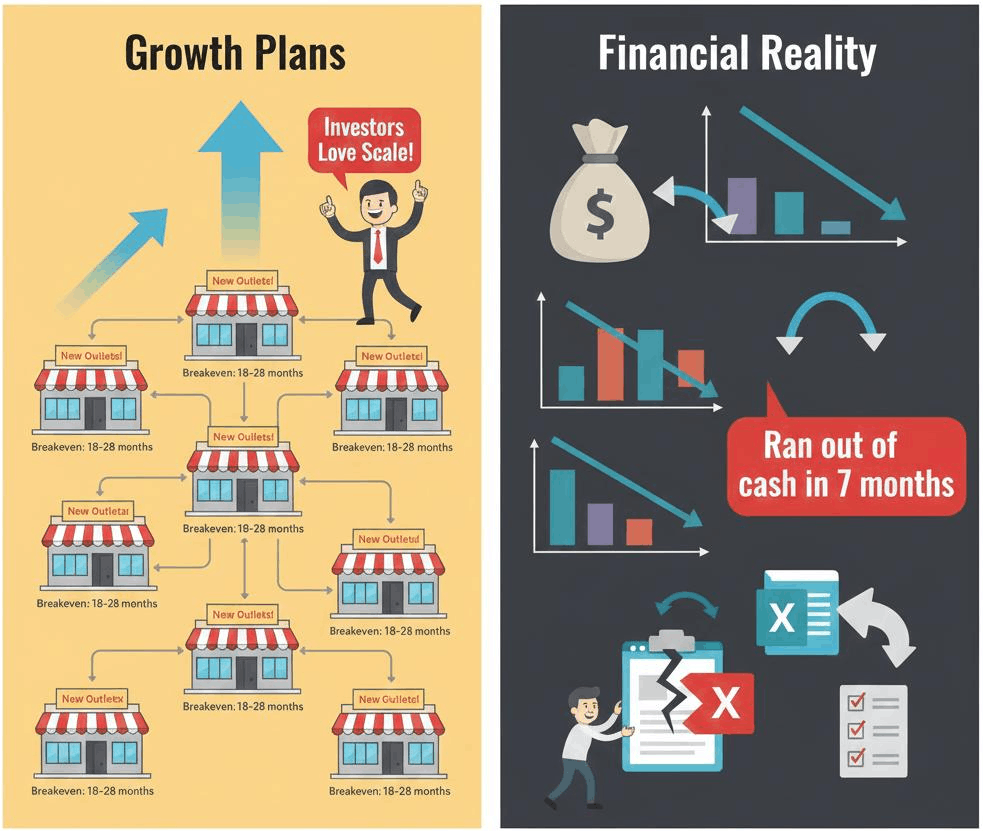

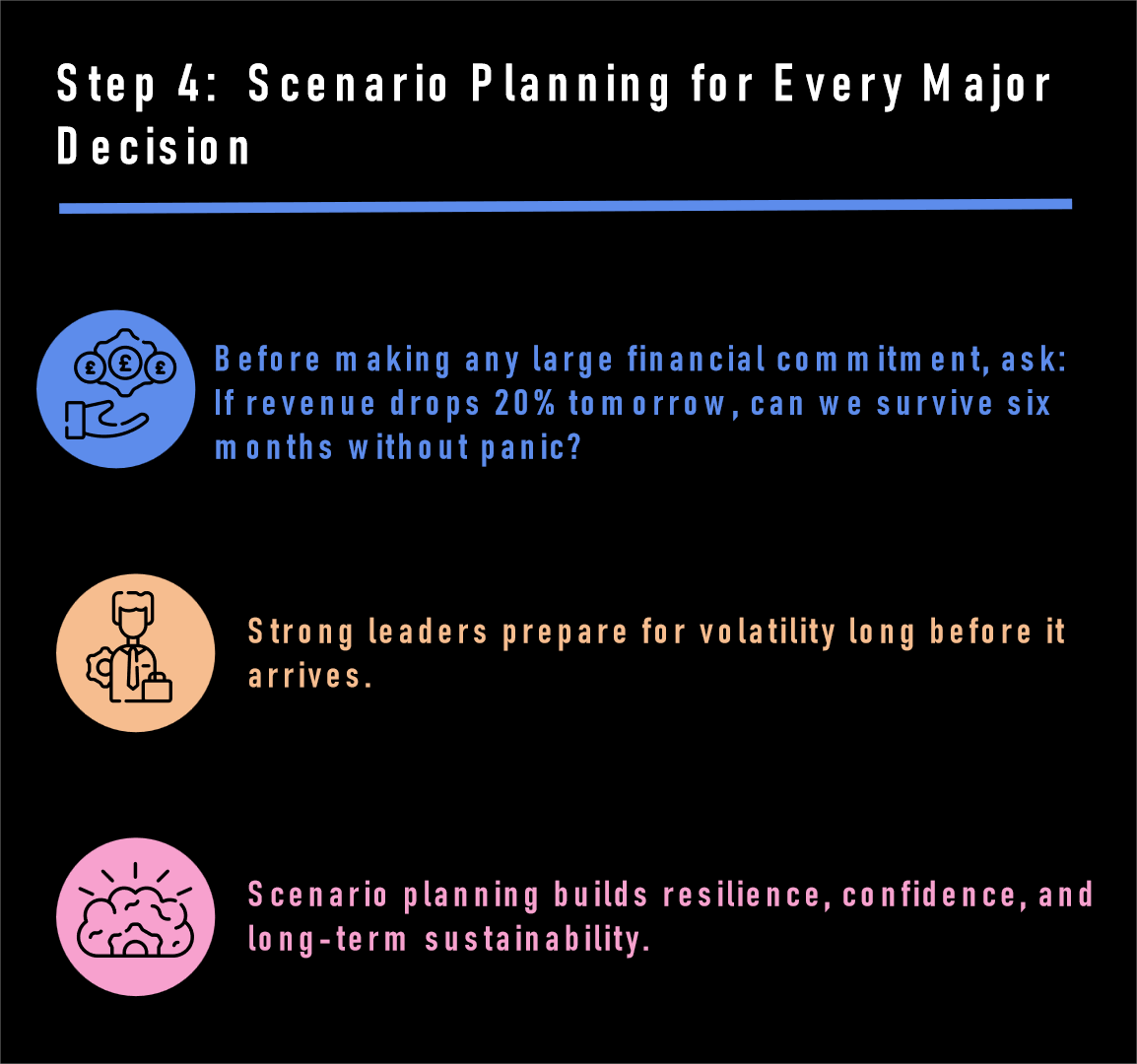

2. Growth Plans Without Unit Economics

Every expansion must answer one simple question: "For every rupee spent, how much returns, and by when?"

A case example where a retail startup invested heavily in new outlets because "investors love scale,"

Each branch took 18-28 months to break even. The company ran out of cash within 7 months and the compliance and excel projections couldn't save them.

Lesson Learnt: Unit economics and disciplined financial planning are essential for sustainable growth.

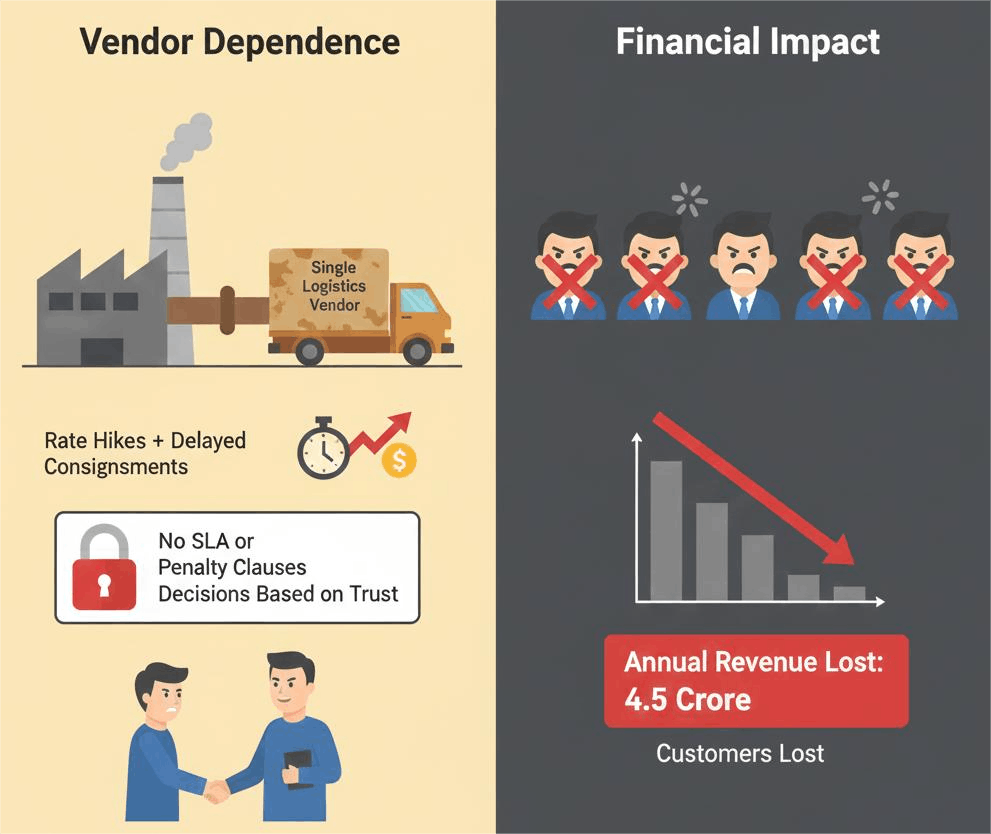

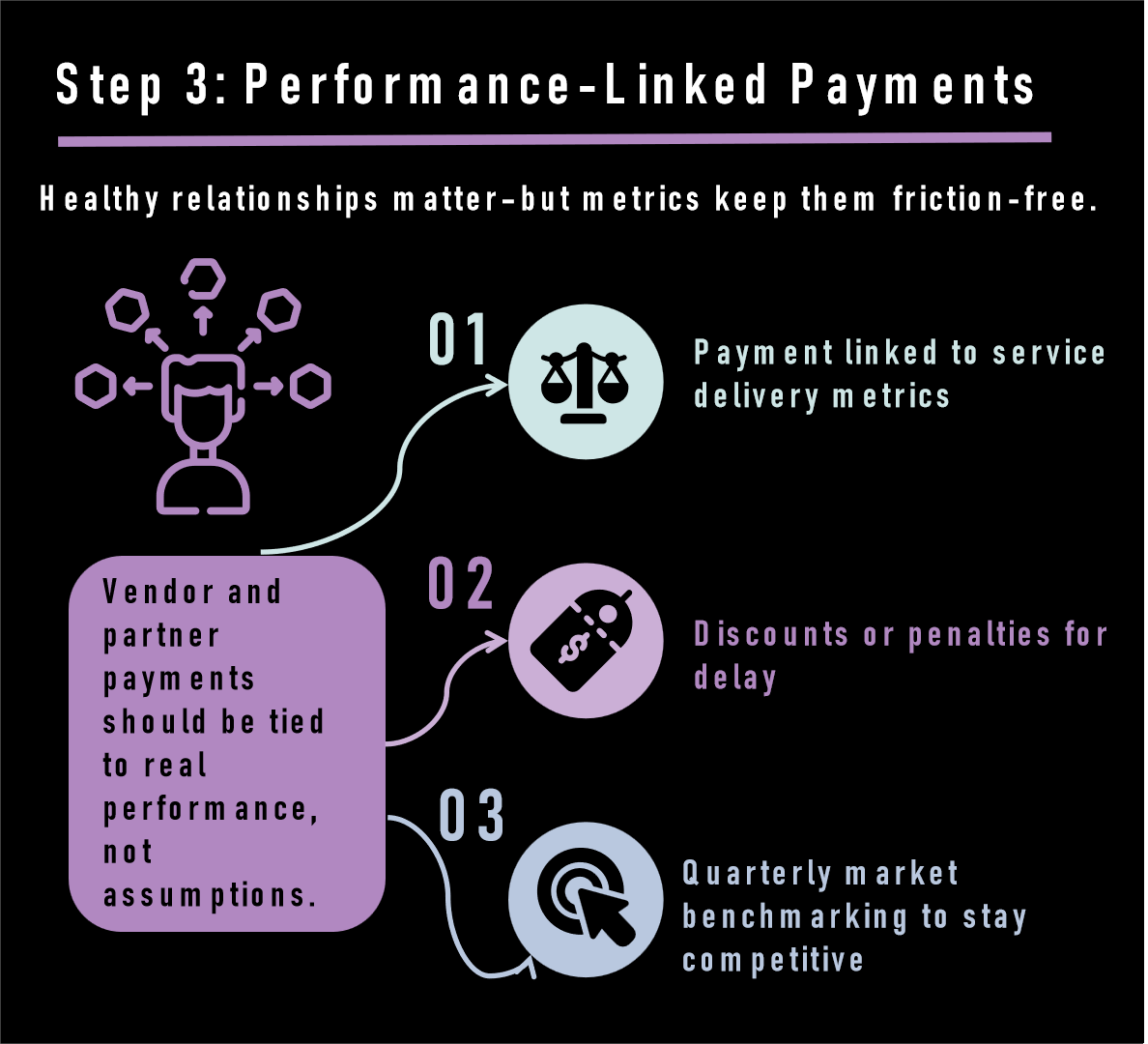

3. Vendor Dependance Without Performance Metrics.

Outsourcing operations is possible–outsourcing accountability is not.

A mid-sized manufacturer relied on a single logistics vendor. Rate hikes + delayed consignments= customers lost. Annual revenue lost: 4.5 crore. No SLA or penalty clauses existed; decisions we based solely on trust.

Lesson learnt: Establish vendor performance metrics and accountability frameworks. Trust alone is a risky financial strategy.

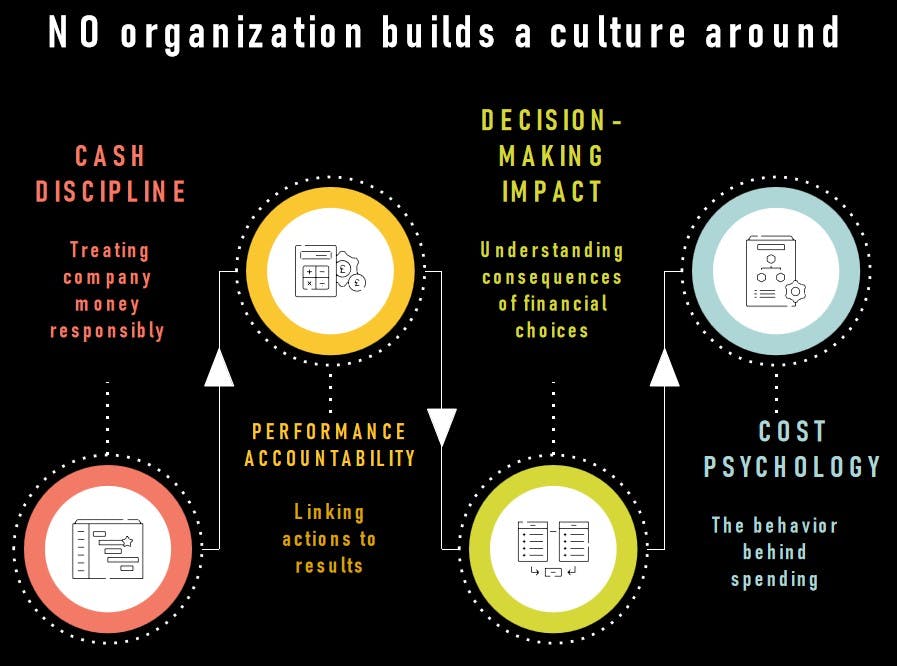

The Discipline Gap: Why Most Leaders Fail at Financial Sustainability

Here's the reality: Finance is not just data–it's behaviour. Employees who treat company money like personal cash drive sustainability. Conversely, those who assume "budgeted= approved to waste" create financial disaster. Key Takeaway: Leaders who focus solely on compliance miss the real driver of financial health: disciplined behaviour and mindful-decision making.

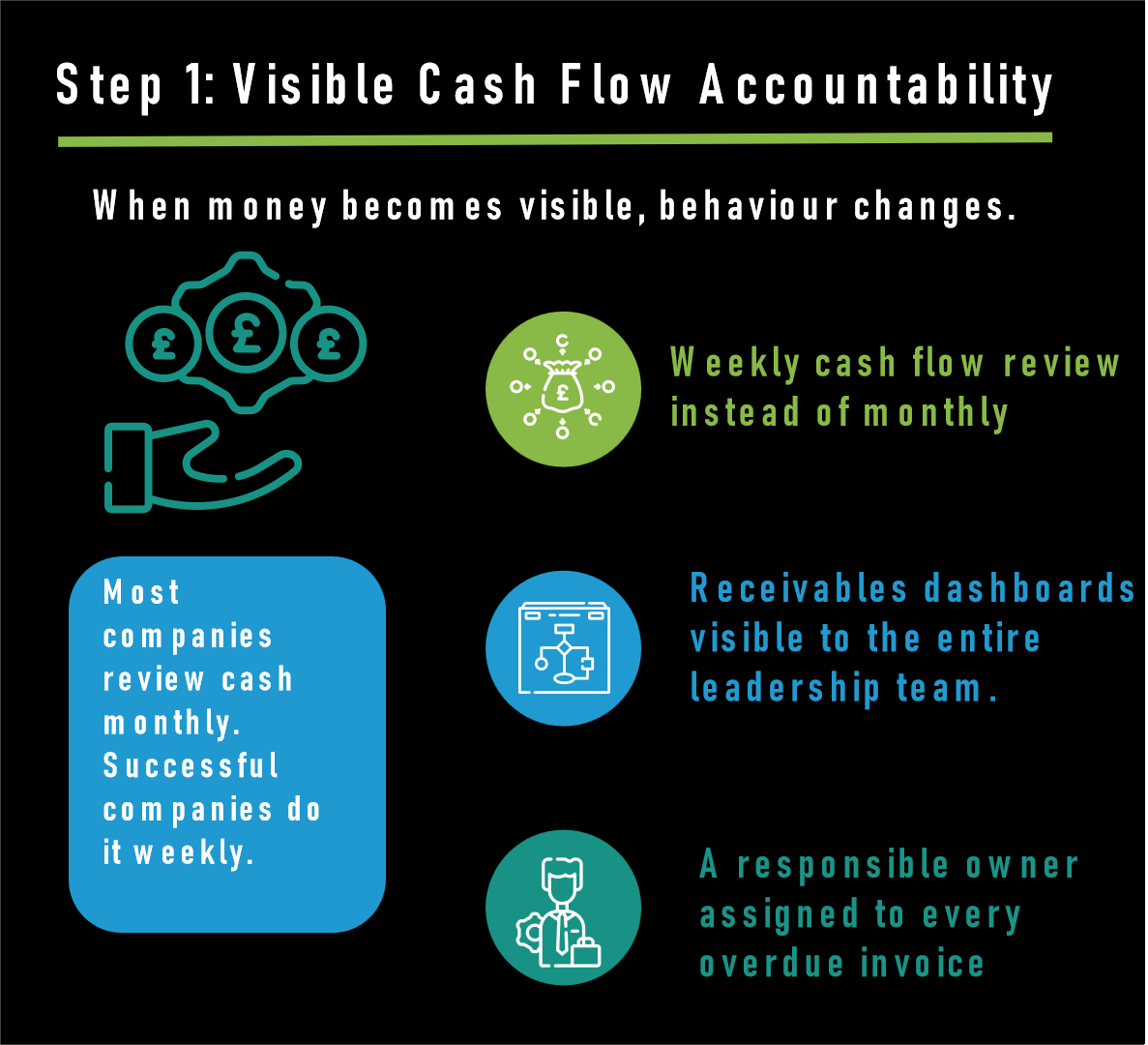

A 4-Step Framework to Build Financial Discipline in Any Organization

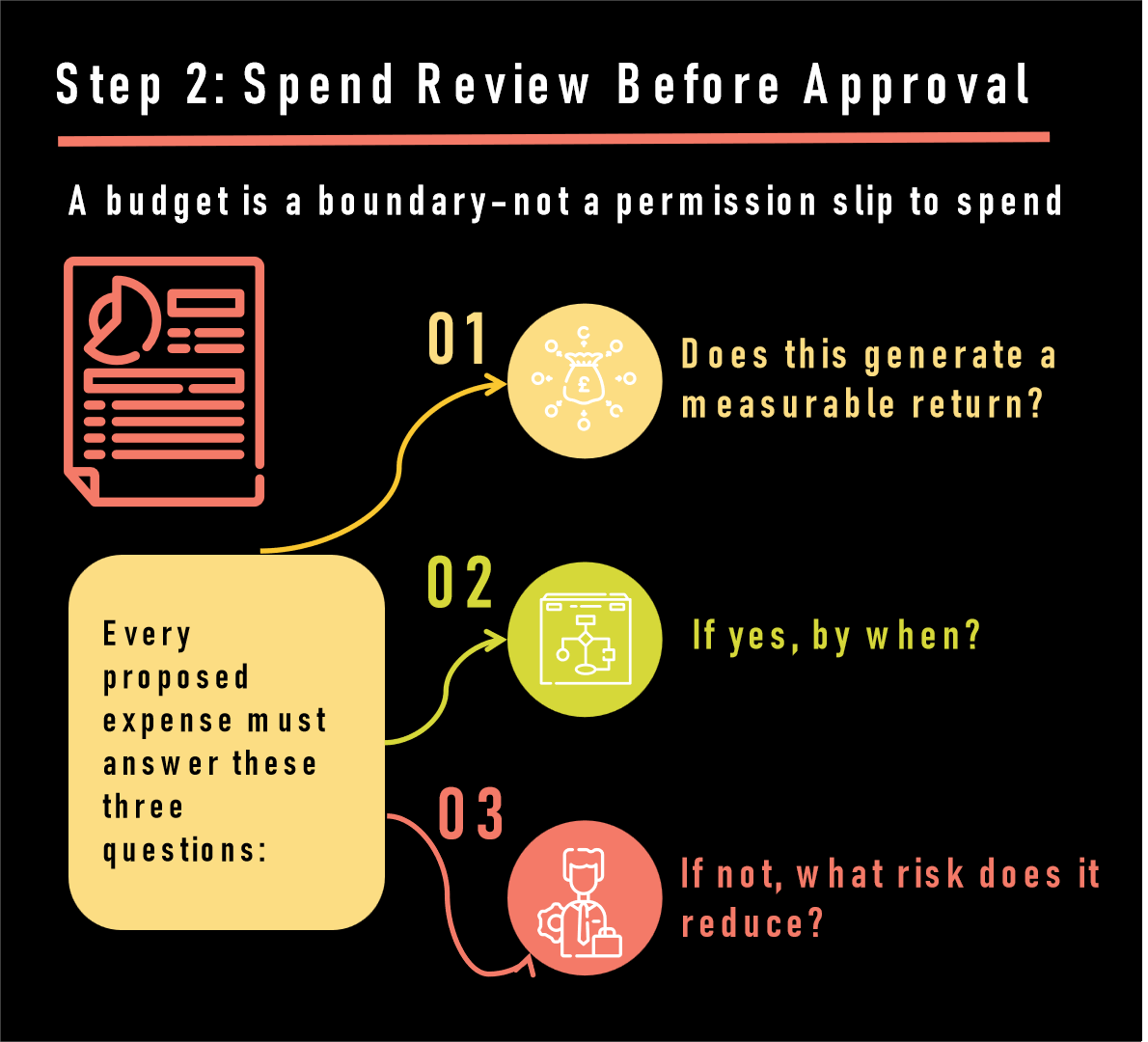

Building financial discipline is not about complex systems–it's about consistent, visible, and accountable behaviour. Here is the simple, practical, and transformative 4-step model to implement today:

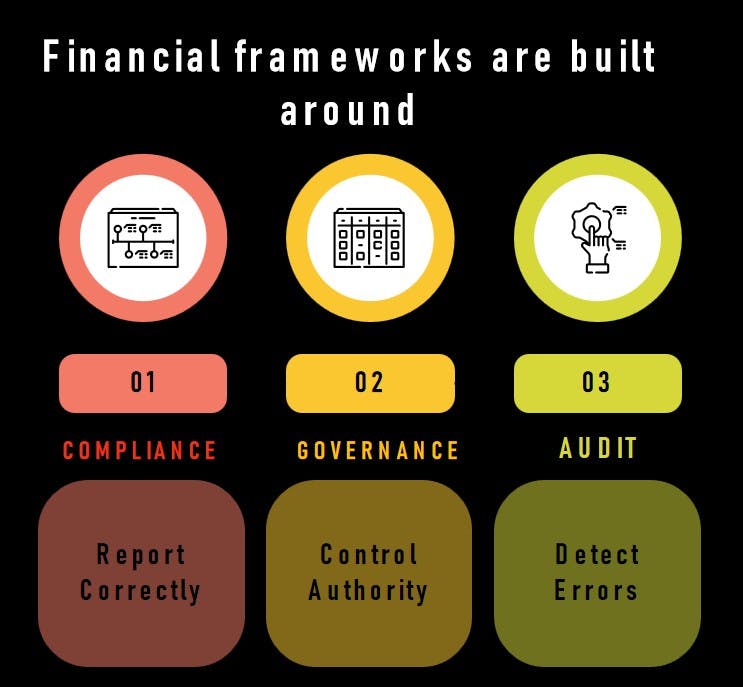

The Real Audit that Matters: Why Compliance Alone Can't Protect Your Organisation

Most companies rely on statutory audits to feel "safe." But safety and sustainability are not the same.

Statutory Auditors vs. Operational Finance

One is Historical and the other is Survival. A CFO once asked me,

"Why should we spend time forecasting risk when we are already compliant?"

One year later, a sudden cash crunch forced layoffs. He returned–this time seeking survival budgeting, not compliance comfort.

Compliance Is the Floor, Not the Roof

Many leaders think: Compliance ≠ Financial Health.

But the truth is: Compliance = Minimum Expectation.

Modern organisations need something far more valuable: Financial Discipline Culture–a mindset where every team member thinks like a steward of the company's future.

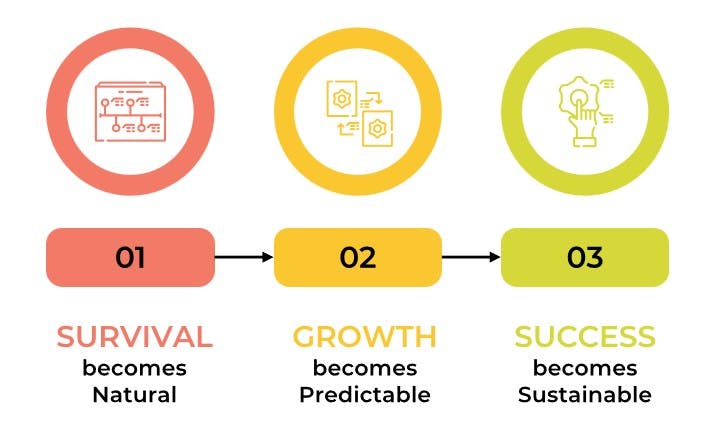

When Financial Discipline Becomes Daily Behaviour

Conclusion

So the real question is: Is our finance healthy–or just legally safe?

Because organisations rarely die from non-compliance.

They die silently when money flows out faster than it flows in. To conclude "MAKE CASH VISIBLE, EVERYTHING ELSE FLOWS"

From ArthaVerse’s lens, true organisational strength comes not from compliance alone but from building a culture where financial discipline shapes every decision.