Just under 4 days ago, the global aviation industry received a jarring wake-up call. Airbus, one half of the commercial aviation duopoly, faced two separate crises that grounded thousands of aircraft and left airlines scrambling. The incidents exposed a critical vulnerability: when only two players control an entire industry, there's nowhere to turn when one stumbles.

A Perfect Storm for Global Aviation

Just a few days ago, Airbus issues an emergency directive grounding nearly 6,000 A320-family aircraft worldwide–marking one of the largest recalls in the company's 55-year history. The grounding was triggered by solar-radiation interference that corrupted the A320's flight-control software, leading to a serious incident on 30 October 2025, when a JetBlue aircraft experienced an uncommanded altitude drop, injuring 15 passengers. With the crisis unfolding during one of the busiest global travel weekends, airlines across multiple continents rushed to implement urgent software patches and safety updates.

Before the aviation sector could stabilize, a second Airbus A320 crisis emerged. The company confirmed a fuselage panel quality defect affecting multiple A320-family aircraft in production, forcing delivery delays and triggering a share price drop of nearly 10%. For airlines already struggling to meet surging post-pandemic travel demand, the timing of these Airbus manufacturing and safety issues could not have been worse.

The Duopoly Dilemma: How Airbus and Boeing's Dominance Creates Global Aviation Risk

The commercial aviation industry is effectively controlled by just two major manufacturers: Airbus and Boring. This tight duopoly became painfully evident when Boeing's 737 MAX fleet was grounded after the tragic crashes in 2018 and 2019. With Boeing sidelined, airlines rushed to Airbus for replacement aircraft–only to discover the limits of relying on a single alternative.

Boeing's struggles deepened in January 2024 when an Alaska Airlines experienced a mid-flight door plug blowout. The incident triggered an FAA grounding and exposed deeper, systemic quality-control issues across Boeing's production lines.

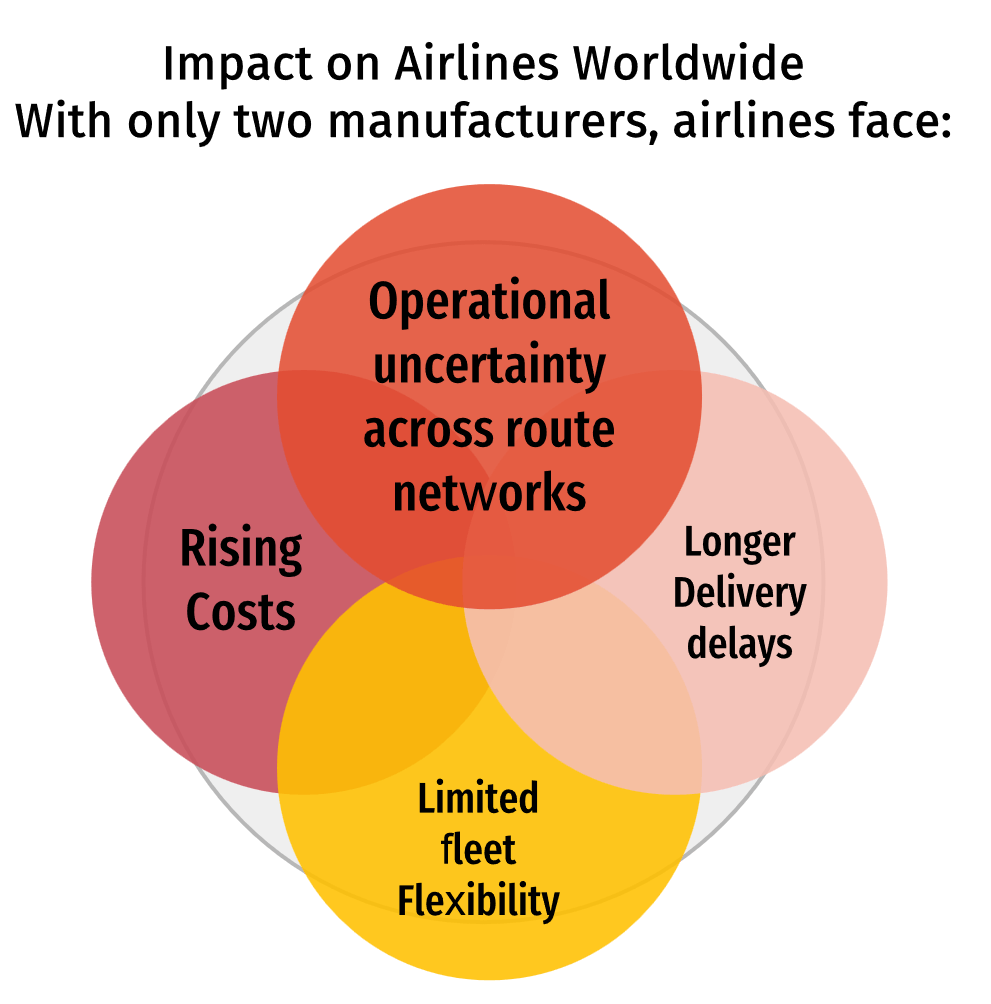

But the problem doesn't end with Boeing. Airbus is now facing its own production bottlenecks and supply chain challenges, leaving airlines with no viable third option. The result? Carriers around the world are grappling with delayed deliveries, rising costs, and operational uncertainty.

This extreme concentration of market power not only constraints airlines–it creates systemic risks for global aviation, where the failures of just one manufacturer can ripple across the entire industry.

Disadvantages of Duopoly Markets

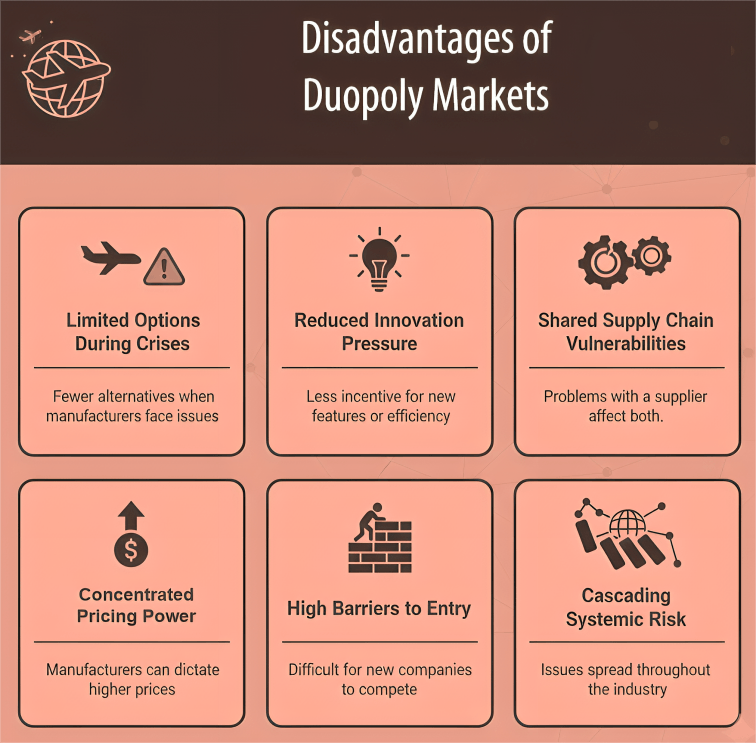

1. Limited Alternatives in Crises

With only two suppliers, any production or safety issue leaves customers–such as airlines–with no viable fallback. Long order backlogs make switching impossible.

2. Lower Innovation Pressure

Minimal competition reduces incentives for breakthrough technology, efficiency gains, or rapid product improvements.

3. Higher Supply Chain Vulnerability

Shared suppliers mean that disruptions–whether engines, fuselage panels, or critical components–can stall the entire industry.

4. Greater Pricing Power

Fewer competitors allow manufacturers to maintain higher prices, increasing costs for airlines and ultimately passengers.

5. Massive Entry Barriers

Extreme capital requirements, regulatory demands, and entrenched relationships make it nearly impossible for new aerospace manufacturers to enter the market.

6. Systemic Industry Risk

When both dominant players face issues simultaneously, the global aviation ecosystem has no backup, creating cascading operational and economic risks.

The Value of Competitive Landscapes

Competitive markets deliver benefits that duopolies cannot:

1. Resilience Through Diversity

Multiple suppliers prevent industry paralysis. When one fails, customers can shift orders and maintain growth plans.

2. Faster Innovation

Competition pushes companies to advance technology, efficiency, and customer experience–creating value for everyone.

3. Better Pricing for Customers

Competitive pressure naturally drives prices down, benefiting airlines and ultimately passengers.

4. Distributed Risk

With varied suppliers and technologies, disruptions are less likely to hit the entire industry at once.

5. Opportunity for Specialization

Diverse players can focus on niches–efficiency, long range, passenger comfort–creating a richer, more adaptable ecosystem.

6. Dynamic Market Evolution

Multi-player markets evolve faster, responding quickly to changing customer needs and technological progress.

The Parallel in Financial Markets

Aviation isn't the only sector affected by concentration. Financial markets, investment platforms, and business intelligence tools often show the same pattern: a few dominant companies limiting choice and slowing innovation. This is why platforms that enable competition are increasingly essential.

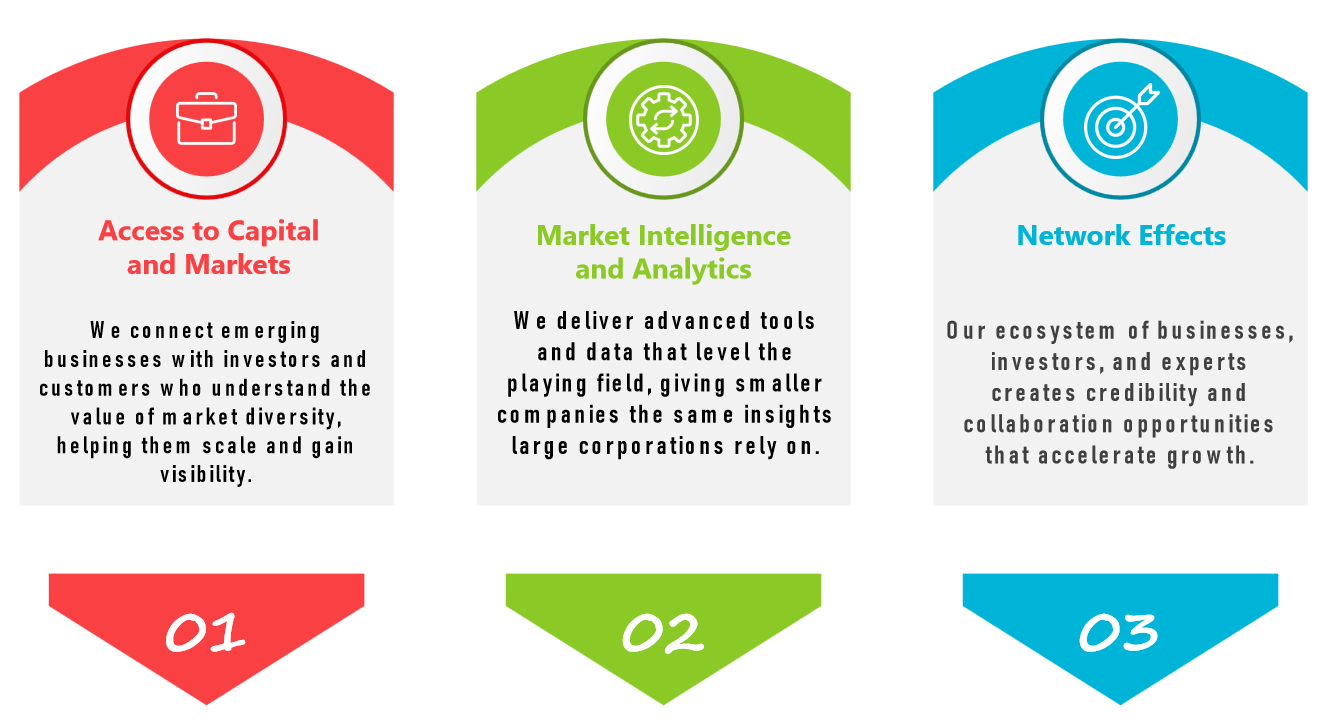

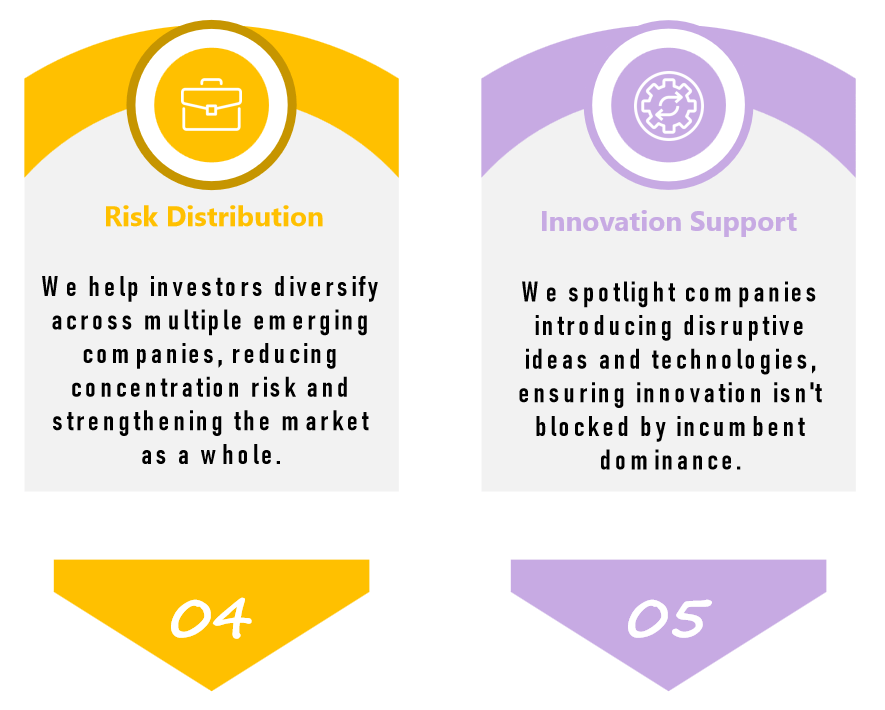

How ArthaVerse Enable Competitive Markets

At ArthaVerse, we believe strong markets depend on having many strong players. Our platform is designed to support emerging companies so they can grow and ultimately compete with established leaders.

What we Provide

The Path Forward

The recent Airbus issues underscore the risks of over-concentrated markets. Whether in aviation, technology, or financial services, excessive dominance creates systemic vulnerability. The answer isn't to weaken successful companies–it's to strengthen competition by supporting emerging players. Industries perform better when multiple companies innovate, challenge each other, and drive progress.

As aviation navigates its current challenges, the message is clear: markets are safer and more resilient with more than two strong competitors. This principle applies across every sector of the economy.

At ArthaVerse, we're focused on building those additional "wings"–empowering the next generation of challengers and enabling diverse, competitive, and resilient markets that benefit everyone.