In 2010, India’s burgeoning microfinance industry broke open with a wave of suicides in Andhra Pradesh to expose the sinister side of its unethical business practices. As I had a front-row seat to this tragic turn of events, I learned that even the most well-intentioned movements can become deadly, especially when profit overshadows purpose.

It was an unexpected turn of events that led me into the microfinance industry in 2005, when I had the opportunity to join the Indian chapter of a global microfinance organization. For the next six years, I found myself on an amazing journey of discovering the nuances of the microfinance industry in the microfinance company that gave me my start, and later, an impact investment company that provided wholesale debt to microfinance entities in India. These experiences helped me closely study the many shapes that microfinance loans embody in the economic landscape of rural and urban India.

The year 2010, however, changed everything for microfinance companies in India. I had a front row seat to the unfolding of the Microfinance Crisis of 2010 in the then-unified Andhra Pradesh, and this event marked a significant turning point in the country's efforts to provide financial services to the poor.

History of Microfinance in India

Microfinance, essentially, was a banking model that provided small loans to low-income individuals, primarily for the initiation and running of small businesses. For a developing country like India, microfinancing was a godsend to individuals at the grassroots level who were having great difficulty navigating formalized banking services, due to basic challenges such as documentation or lack of awareness. Post Independence, India has seen steady growth in initiatives that promoted financial growth among Indians in rural areas, such as the establishment of rural banks in the 1970s, social entrepreneurs setting up self-help programs in the 1980s, and economic reforms that opened up the industry to the private sector in the 1990s.

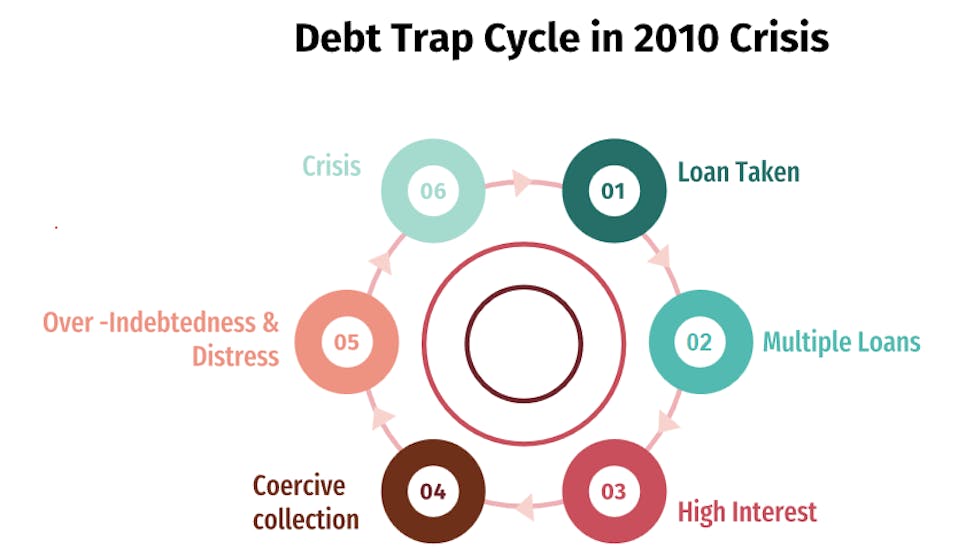

This industry slowly picked up in India in the 1990s and rapidly gained momentum throughout the 2000s because of the growing number of microfinance institutions that were being established. What eventually led to the crisis was the crossing over of institutions from non-profit to for-profit models. This switch and expansion were accompanied by increasingly aggressive lending practices and a focus on profit over social impact. Another massive challenge was the wildly unregulated interest rates that could range anywhere from 11% to 24%, as opposed to the 9-10% annual interest rates of loans from the banking sector. The microfinance loans also came with the unethical baggage of widespread coercive loan recovery tactics, borrower over-indebtedness, and multiple loans issued to the same individuals.

The focus on profit and the disregard for people-centered financing played a key role in what was to come in 2010.

Andhra Pradesh: Hub of the Microfinance Crisis of 2010

These issues came to a head in the Southern Indian state of Andhra Pradesh in 2010, when the global spotlight was angled towards the borrower suicides in Andhra Pradesh, many of which were linked to the constant harassment from loan agents. Media reports and public outrage propelled the state government to pass an ordinance in October 2010 that imposed strict controls on microfinance institutions (MFIs). Practices surrounding collections, interest rates, and the number of loans a borrower could take were closely scrutinized, and stringent restrictions were drafted and enforced accordingly. The ordinance did significantly disrupt operations for MFIs, many of which were publicly listed companies. Loan repayments plummeted, investor confidence eroded, and the sector’s reputation suffered long-term damage.

The Drivers Behind the Crisis

Rapid commercialization of microfinancing was one of the key drivers of the 2010 crisis. Although the sector was introduced and built to be a tool for alleviating poverty and empowering excluded groups in society, especially women, by 2010, it had completely lost its plot because of domination by profit-driven private institutions. These MFIs disregarded client protection and responsible lending to prioritize scaling businesses and widening profit margins. Unchecked growth in this industry was largely due to the lack of strong regulations over how loans were being issued or collected.

In the aftermath of the crisis, the Reserve Bank of India (RBI) and the central government took steps to fortify regulations and increase transparency. The Malegam Committee, set up by the RBI, issued recommendations in early 2011, including the creation of a credit bureau for microfinance clients, caps on interest rates, and better customer grievance mechanisms. These reforms helped stabilize the sector and reorient it toward more responsible practices.

The 2010 microfinance crisis underscored the dangers of unregulated financial inclusion and the need to balance social objectives with financial sustainability. It remains a cautionary tale about the risks of prioritizing growth and profit at the expense of the borrower’s welfare.

Lessons from the 2010 Microfinance Crisis

Every crisis in the world of Finance reveals key takeaways for us to glean, and the Microfinance Crisis of 2010 that rocked Andhra Pradesh is no exception. Here are some of the lessons in business management that I have mined from my experiences with this difficult chapter in microfinancing history:

Under Management of Assets: All organizations undergo a downward spiral when their assets are not properly managed, as this is the fastest means of incurring heavy losses and lowering sustainability parameters.

Multiple Income Streams: Organisations that had diligently built up multiple income streams over time, ahead of the crisis, weathered the storm, and survived.

Strong Ecosystem: One of the other main factors that contributed to the survival of a few organisations was the presence of a strong ecosystem that supported them, unlike the companies that lacked a firm system to hold them up.

Proactive Action: In times of crisis such as this one, organizations that were able to foresee potential pitfalls in an unpredictable environment and take proactive, critical steps to cut down on expenses and fortify operations survived.

Ultimately, the bottom line is never the bottom line: as a business owner, everything I do rests on the state of my ethics and my service to the customer. The 2010 Crisis will forever remind me that I cannot afford to lose sight of that primary objective.